主营产品有永磁吸盘、单轨行车、搬运坦克车、弹簧平衡器、千斤顶、电动葫芦、手拉葫芦等多种产品,多年生产经营积累,产品质量保证。产品不仅畅销全国各个省市,而且还远销美国、法国、德国、俄罗斯、印度、马来西亚、澳大利亚等三十多个国家和地区,与国内外客户建立了良好的业务关系,深受好评,逐步形成了经营贸易相结合,产、供、销、服务一条龙的经营模式。

步入二十一世纪,达味集团实行现代化企业管理制度,以质量作为生存资本,以品质赢得客户、开拓 市场,以规模静音降低成本。面对激烈的市场竞争,企业在加大内部改 革的同事将一如既往地坚持企业的宗旨:“同样的产品比质量,同样的质量比价格,让利不让市场。”热沈欢迎国内外客户建立业务联系’谋求共同的发展。查看更多>>

常规型号下单即发货,特殊规格全面定制

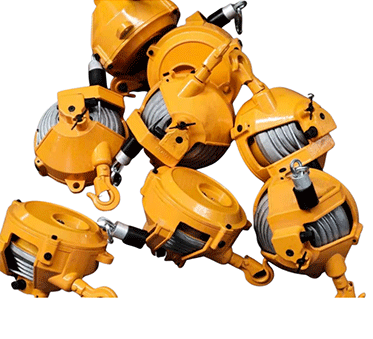

弹簧平衡器使用方法: 1.根据被悬挂物的重量选择合适规格的平衡器。安装前请阅读说明书。 2.将平衡器的吊环悬挂在工位上方牢固的梁或节点上,并注意:用户必须将安全孔穿上安全绳

弹簧平衡器使用方法: 1.根据被悬挂物的重量选择合适规格的平衡器。安装前请阅读说明书。 2.将平衡器的吊环悬挂在工位上方牢固的梁或节点上,并注意:用户必须将安全孔穿上安全绳

弹簧平衡器使用方法: 1.根据被悬挂物的重量选择合适规格的平衡器。安装前请阅读说明书。 2.将平衡器的吊环悬挂在工位上方牢固的梁或节点上,并注意:用户必须将安全孔穿上安全绳

选择弹簧平衡器时,除了要考虑悬挂的工具重量外,还要考虑其它附属设备的重量。如焊装车间悬挂电焊钳,除要考虑电焊钳的重量外…

选择弹簧平衡器时,除了要考虑悬挂的工具重量外,还要考虑其它附属设备的重量。如焊装车间悬挂电焊钳,除要考虑电焊钳的重量外…

选择弹簧平衡器时,除了要考虑悬挂的工具重量外,还要考虑其它附属设备的重量。如焊装车间悬挂电焊钳,除要考虑电焊钳的重量外…

选择弹簧平衡器时,除了要考虑悬挂的工具重量外,还要考虑其它附属设备的重量。如焊装车间悬挂电焊钳,除要考虑电焊钳的重量外…

同样的产品比质量,同样的质量比价格,让利不让市场

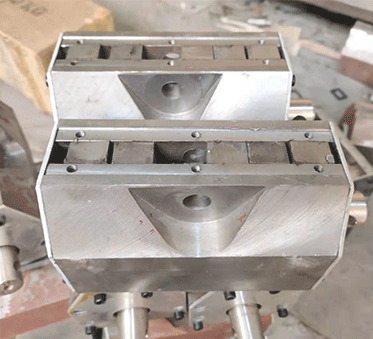

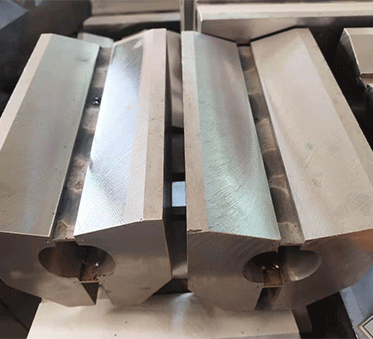

优质Q235铁板、Nd-Fe-B N45,

原料保障成品品质

客户需求精益求精,满足产品

规格、颜色、尺寸等定制要求

CNC加工中心成熟工艺,

高品质产品深受广大客户青睐

绿色环保国标品质喷漆,

人性化设计安全耐用

每批产品试拉质检,

专人审查拒绝低质产品

庞大产能轻松实现大

批量产品供应

随时掌握行业资讯,实时了解起重机械动态

版权所有:金沙(3777-VIP认证)娱场城-BestAppStore备案号:冀ICP备2021001069号-1 【网站地图】